Your hard work is what continues to make Lam successful, and the Employee Stock Purchase Plan (ESPP) is a way for you to share in that success. With the ESPP, you can buy Lam stock at a discount through payroll deductions.

What you need to know

- Regular employees who work 20 hours or more per week are invited to join the ESPP. If you’re eligible, you’ll receive an email when the enrollment period begins.

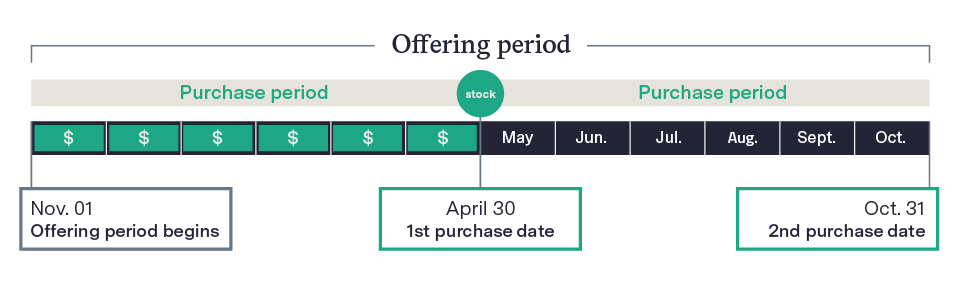

- You can enroll to participate in a 12-month offering period during which you make after-tax contributions to the ESPP through payroll deductions. Enrollment typically occurs for two weeks every April and October. You can stop participating in the ESPP at any time.

- You can contribute between 1% and 15% of your salary to purchase stock up to a maximum market value of $25,000 a year. Your contributions will stop once they reach $21,250 to account for the 15% purchase price discount off the market value.

- ESPP participants get a 15% discount on Lam stock on the purchase date. At the end of each six-month purchase period—the last business day of April and October—the money you’ve set aside is used to buy stock for you at a discount of 15%.

- Once stock is purchased, it’s put into your Fidelity investment account for you to hold or sell. You own the stock and can sell it for cash at any time.

- You are not charged commissions or other fees when you purchase Lam stock through the ESPP. Brokerage commissions or fees may apply when you sell stock.

This example illustrates an offering period that begins on November 1 and ends on October 31. An offering period can also begin on May 1 and run through April 30.

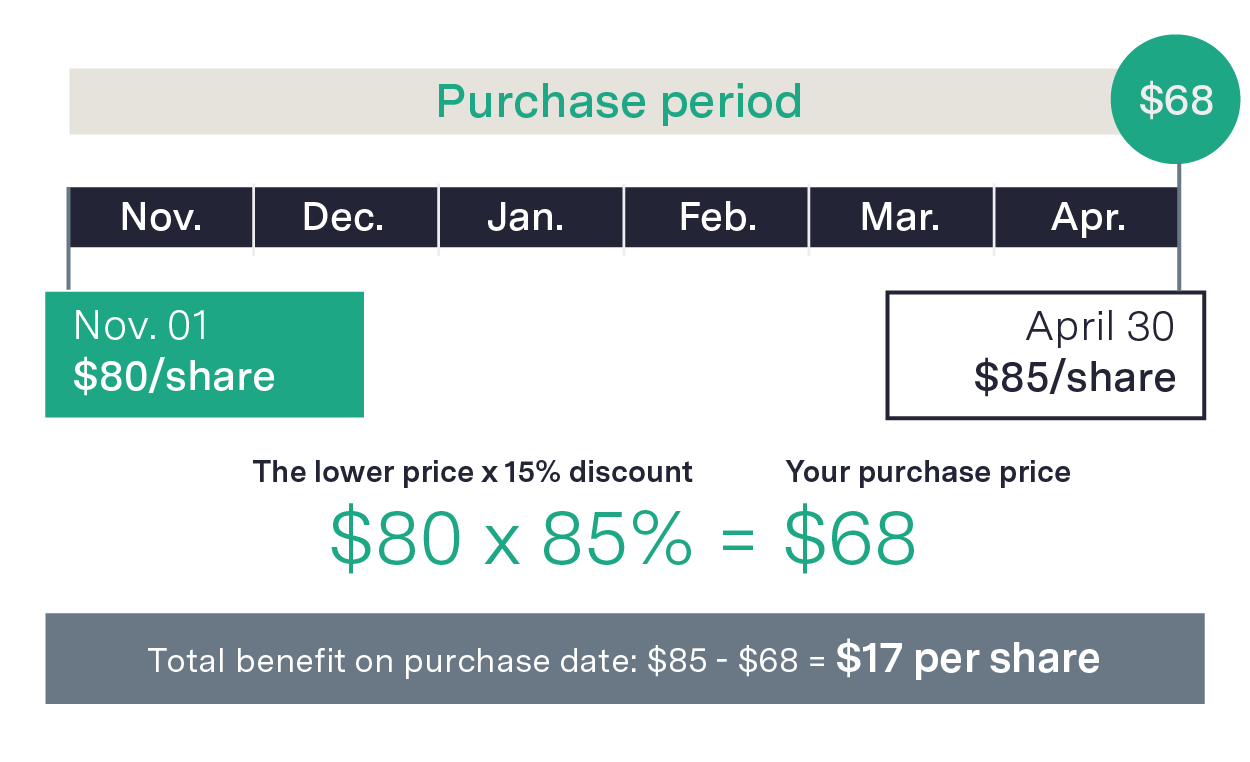

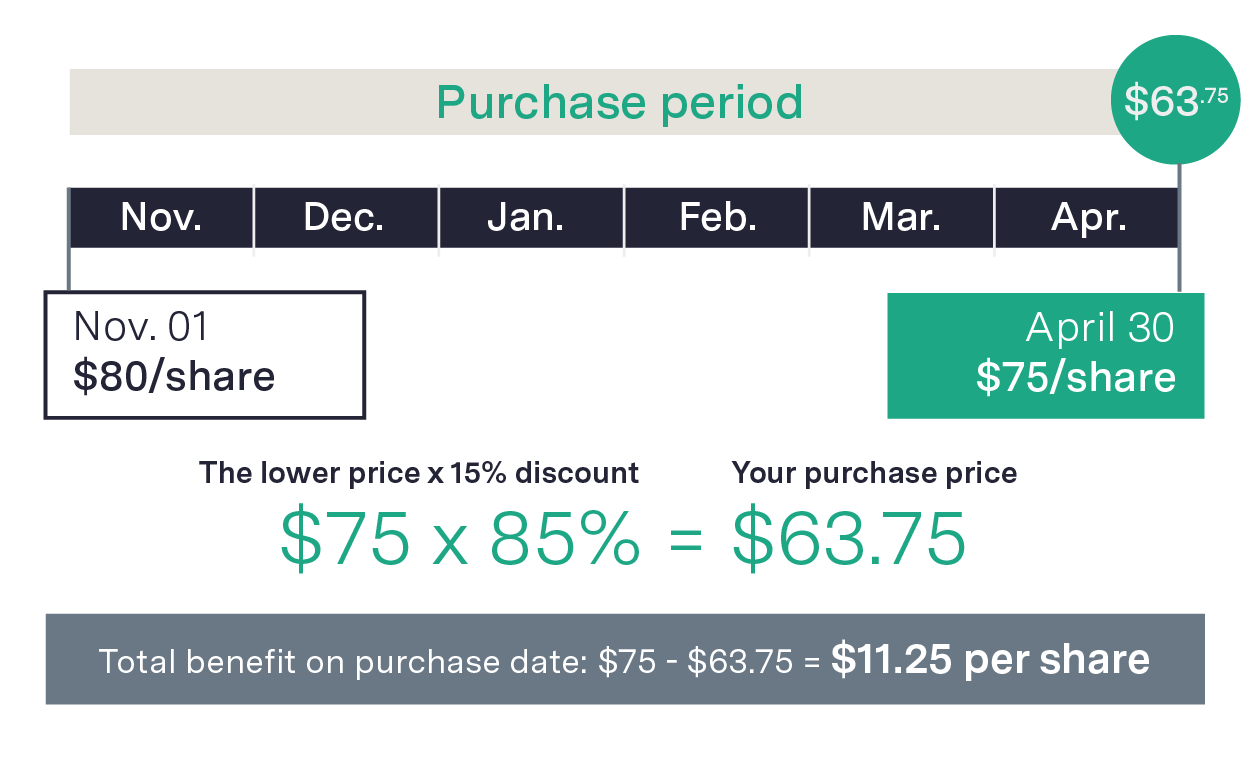

- To determine the ESPP stock purchase price, Lam compares the stock price from two different points in time—the price on the first day of the offering period and the price on the last day of the purchase period.

- To ensure you get the biggest benefit, the 15% discount is applied to the lower of the two stock prices. Since the ESPP compares two prices and chooses the one that’s lower, when Lam’s stock price has increased, your benefit could be even greater than 15% when compared to the price other people are paying to buy Lam stock on the date your purchase is made.

You benefit when the stock price goes up

You benefit when the stock price goes down

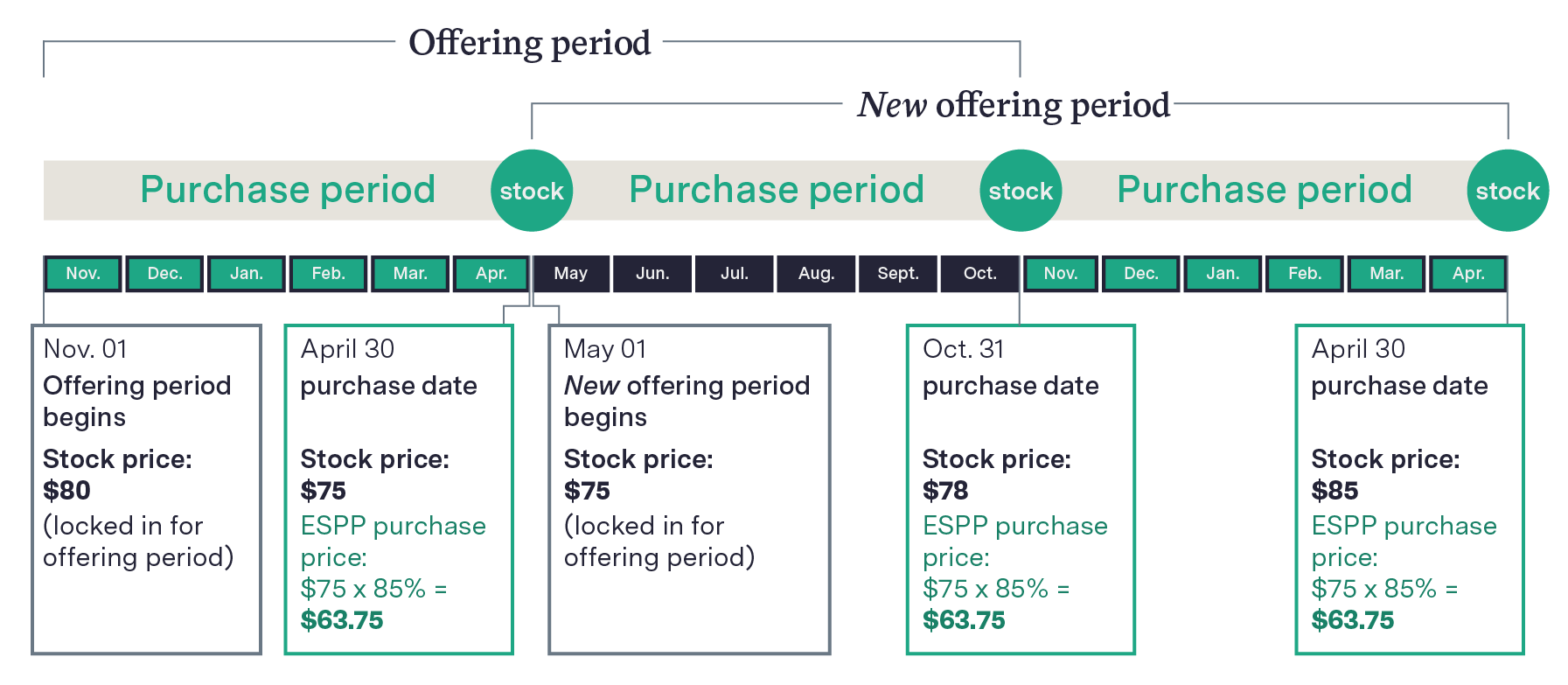

Offering period resets when stock price is down

If the stock price is down on a purchase date, the current offering period ends, and you will be enrolled automatically in a new offering period at a lower stock price. This reset helps ensure that you pay the lowest price possible for your stock on the next two purchase dates.

Where to learn more

This video explains how the ESPP works:

For more detailed information about how Lam’s ESPP works, check out the Employee Stock Purchase Plan Prospectus [PDF].